cash app check deposit fee

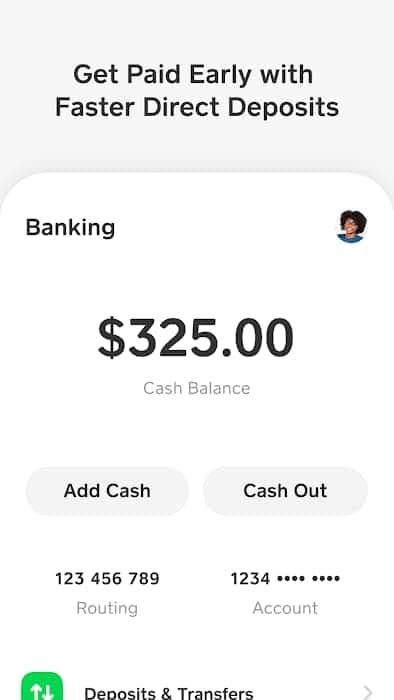

Cash App balances dont earn interest which is an important aspect of a worthwhile deposit account. Sign in to your Cash App account.

Updated Can You Deposit Checks Or Money Orders In Cash App In 2022 Youtube

Cash App charges a 3 fee if you send money from a credit card.

:max_bytes(150000):strip_icc()/A2-DeleteCashAppAccount-annotated-5d48188372ff4dcb945d9c30f361bc4b.jpg)

. Best Free Check Cashing Service. Cash App makes direct deposits available as soon as they are received up to two days earlier than many banks. This app allows you to cash checks receive your direct deposit and send money with very few fees.

You can receive up to 25000 per direct deposit and up to 50000 in a 24-hour period. You can deposit the check through Chime with the help of your mobile by sitting at your home. Typically if you withdraw cash from an ATM Cash App will charge you a fee of 2.

No interest earned on balance. The Cash app doesnt charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. The Mobile Check Capture Terms of Service govern your use of the Mobile Check Capture feature.

There are no minimum account balances no overdraft fees and customers can enjoy over 20000 nationwide fee-free ATM locations. 175 check cashing fee. Unapproved checks will not be funded to your account.

And select the mobile. For business payments the customer is charged 275. Fees and terms apply.

As we mentioned above you can send money across the pond with Cash App though its mainly a US. It charges the sender a 3 fee to send a payment using a credit card and 15 for an instant deposit to a bank account. Standard deposits are free and arrive within 1-3 business days.

Deposit paychecks tax returns and more to your Cash App balance using your account and routing number. View transaction history manage your account and send payments. Cash App direct deposits are made available as quickly as possible once theyre sent.

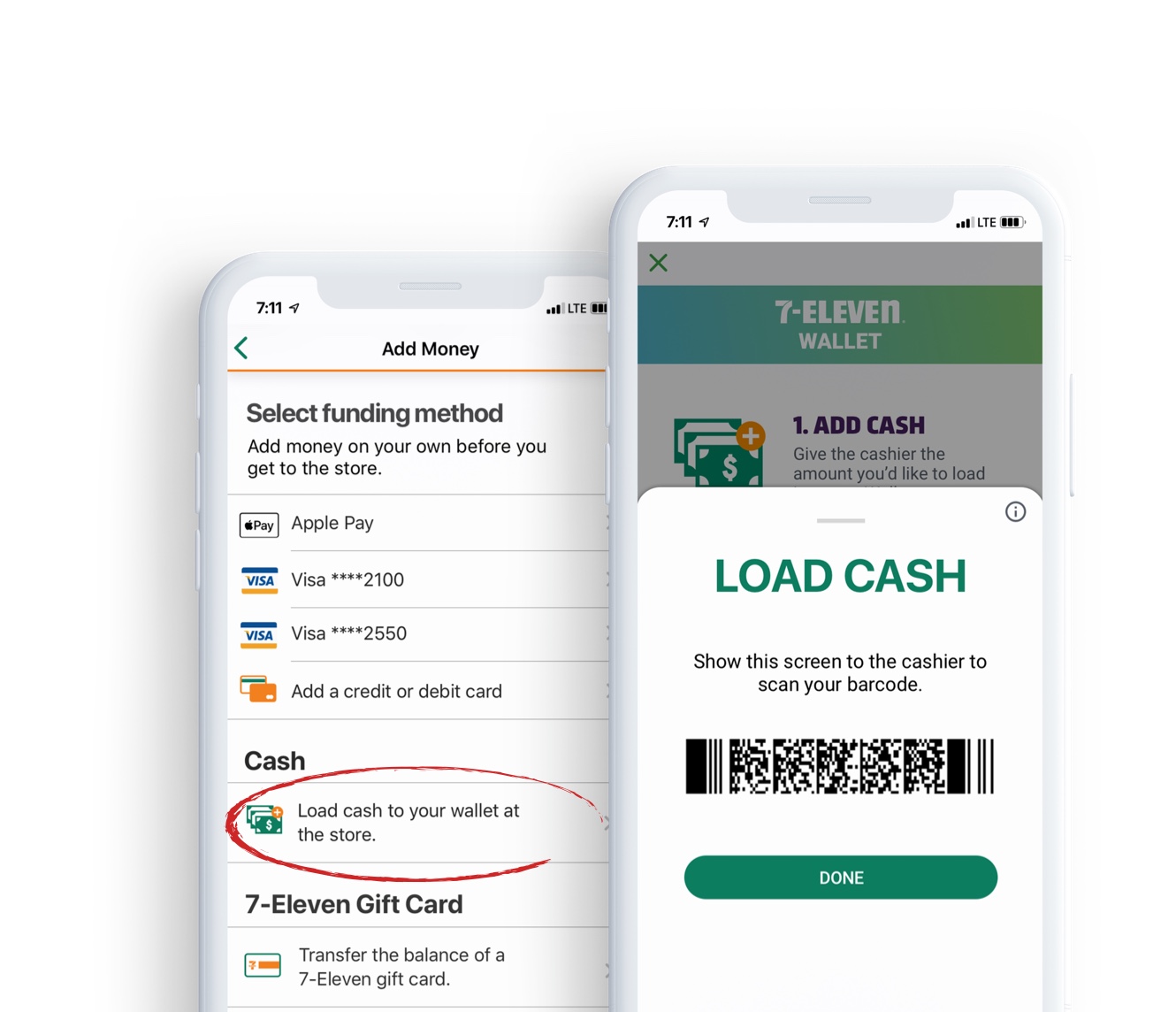

Tap on the Move Money option. By using Cash App you agree to be bound by these Terms and all other. Find a location near you or use the search bar to enter an address.

Cash deposits are charged a 1 fee and there doesnt seem to be any way to have this fee removed. However if you wish to avoid fees you cannot access your money right away. While Cash App itself doesnt mention a specific time of the day on their website it takes about 1-5 days for the funds to hit your account.

There is no hassle no lines no fees and no forms. 075 charge for sending money to family and friends. The 5 promotional incentive will be added to your approved check amount and transaction detail will be maintained in your GO2bank transaction.

Effective February 14 2022 Cash a Check is no longer. Cash App SupportCash Out Speed Options. All checks subject to review for approval.

The Paypal Cash a Check service can help you conveniently deposit checks online. Cash App is not a complete alternative to a real checking account as it does not offer FDIC insurance. Get a one-time 5 credit when you cash a check to your GO2bank account The 5 promo code offer is valid only for users who successfully use the 5 promo code in the GO2bank mobile app before the promo code expires on 123122.

If your check isnt approved to be cashed no fees will be assessed. The minimum fee for all checks is 5. Open the Chime App on your mobile.

However theres no fee to send money from your Cash App balance or bank account even if you send money to someone in the UK. Payment service so it isnt a solution if youre trying to send. Also the funds can land in your account up to 2 days early compared to many banks.

Tap the Banking tab on your Cash App home screen. Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025 and arrive instantly to your debit card. The Cash Card is best used for purchases only and not at ATMs where youll get charged an extra.

5 of the total amount for all other checks. You can deposit up to 2000 per check and up to 10 checks each month. How To Deposit Mobile Check With Chime Account.

Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. However ATM withdrawals become free for 31 days after you direct deposit at least 300 into your account. There are no fees for using the mobile check deposit feature with Cash App though there are some limits to how much and how often you can deposit including a 3500 per check limit and a 5 mobile check deposit limit per month.

If the check bounces or the transaction is not completed for any reason you do not have to pay this fee.

Cashapp New Feature Deposit Paper Money Into Cashapp Find Store Near You Youtube

Cash App Internet Money App Cash

6 Best Check Cashing Apps Get Money Fast Gobankingrates

/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

How To Put Money On A Cash App Card

Can You Deposit Checks Or Money Orders In Cash App Youtube

How To Direct Deposit On Cash App Step By Step

How To Direct Deposit On Cash App Step By Step

Cashapp Transfers Straight To Your Cash App Account

Cashapp Transfers Straight To Your Cash App Account

How To Direct Deposit On Cash App Step By Step

Can You Deposit Checks Into Cash App Youtube

6 Best Check Cashing Apps Get Money Fast Gobankingrates

What Is Cash App Direct Deposit Feature How To Get Money App Directions

How To Access The Direct Deposit Form On The Td App