are raffle tickets tax deductible australia

If you are a US. The result of this is that individuals whose purchases involve raffle tickets items or food cannot benefit from an.

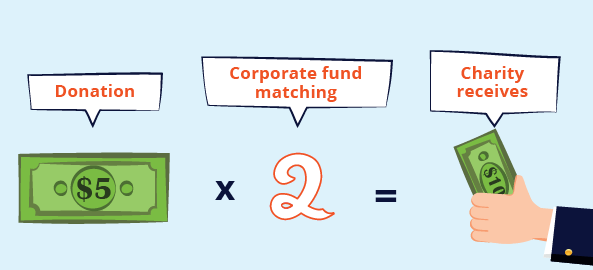

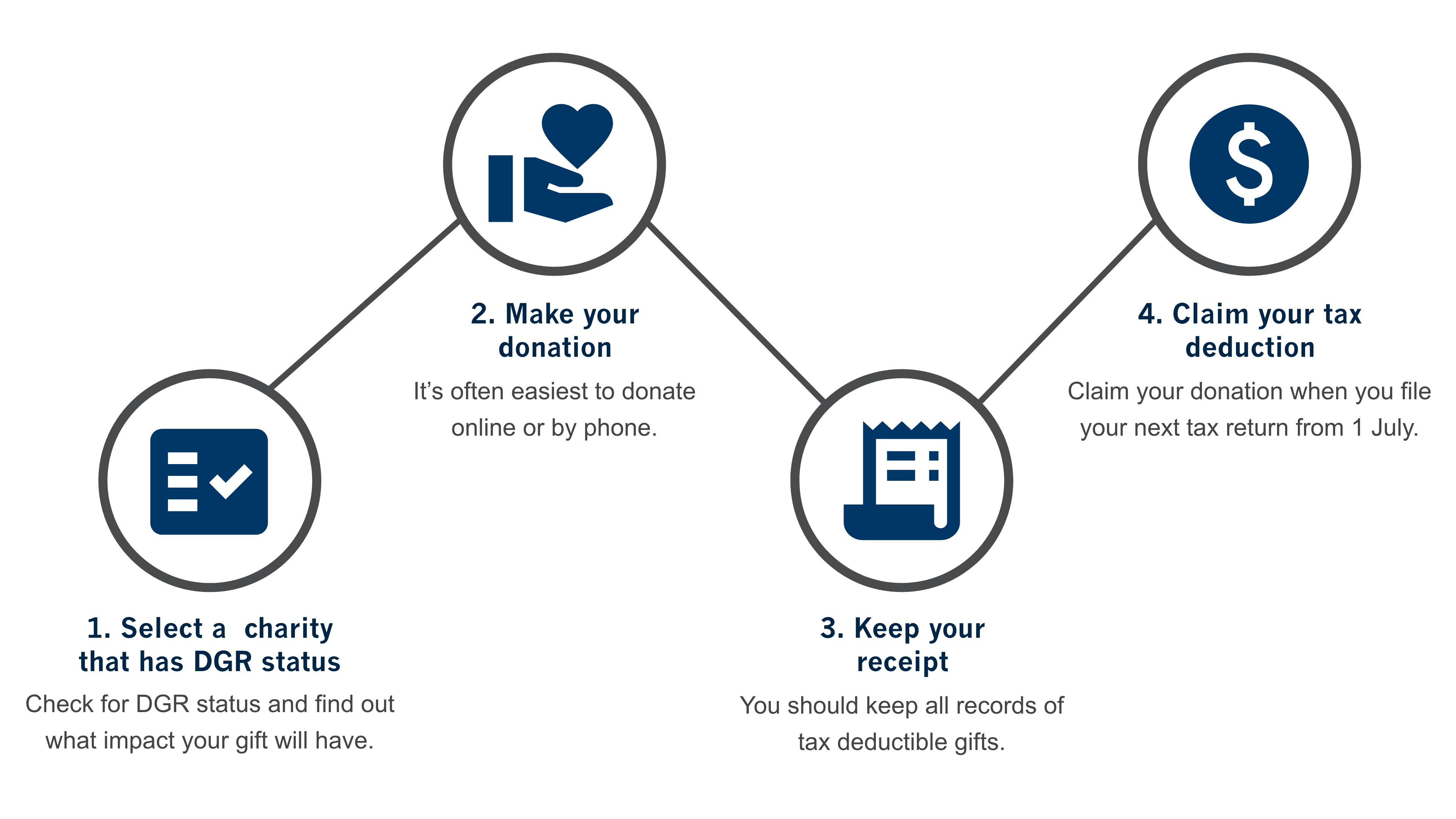

Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return.

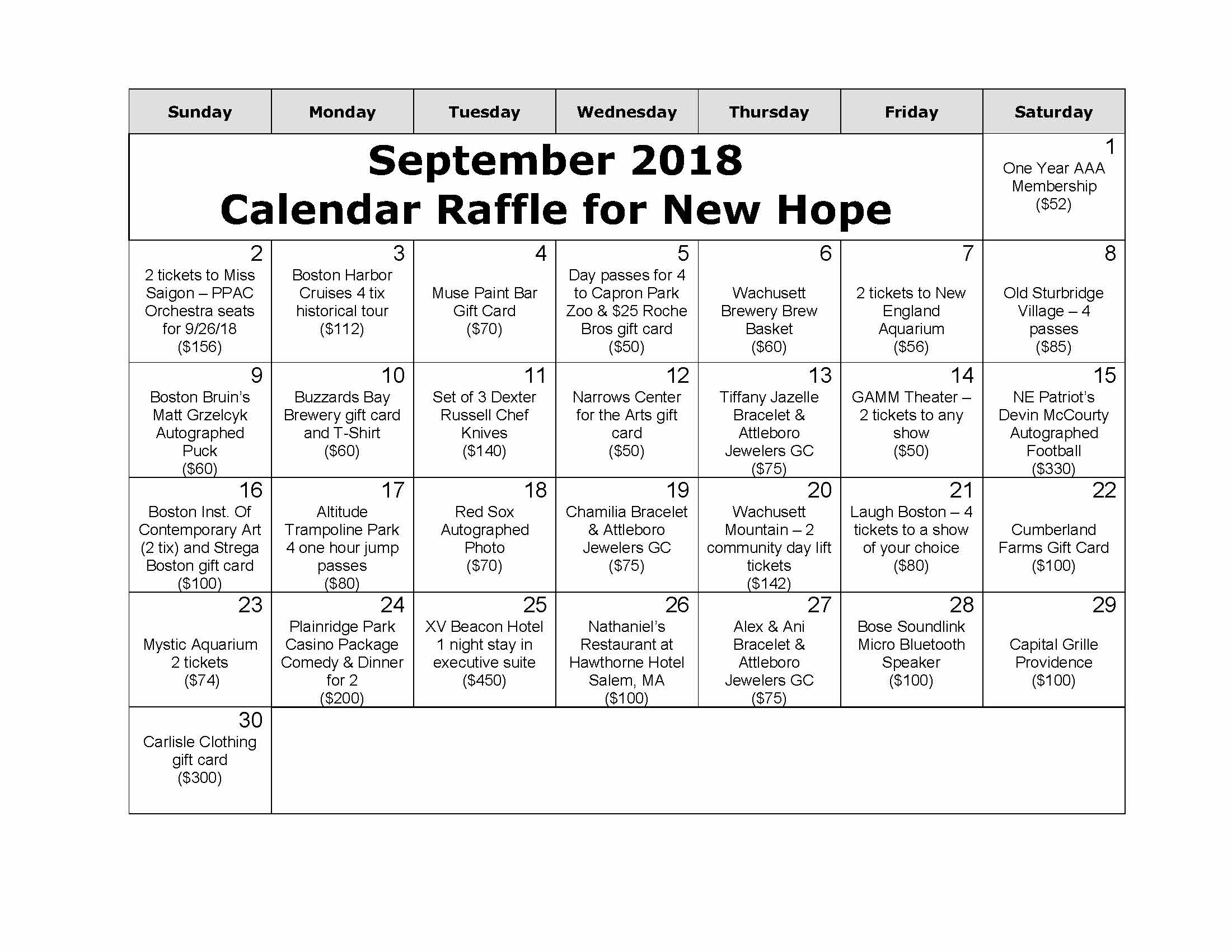

. No raffle ticket purchases are not tax-deductible only charitable donations are. Enter now for your chance to win great prizes. The raffle drawing will take place on Thursday April 21 2022 at 12 pm.

The tax office defines this as a transaction where you receive a good or service in return. Some donations to charity can be claimed as tax deductions on your individual tax return each year. First of all if you receive a raffle ticket dinner attendance event entry chocolates or anything like that then your donation cant be claimed as a deduction.

Your Tips And Tricks To Saving Time And Money On Your Tax Return Abc News Australian Broadcasting Corporation - A raffle ticket or pen then it doesnt qualify as a tax deduction. Does the purchaser receive a receipt or invoice. In fact to claim donations you need to be donating to a recognised charitable organisation.

Basically if you receive something because of your donation then dont claim the donation as a tax deduction. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. While most deductions are expenses directly related to earning your income gifts and donations can also be tax deductions.

Are Raffle Tickets Tax Deductible Australia. All federal and state tax requirements must be satisfied before award. This means that purchases from a charity that involve raffle tickets items or.

Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. In order to deduct lottery tickets from your taxes you have to itemize. In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations.

You cannot claim a deduction for a purchase for example raffle tickets. Site protected by. Raffles and bingo tickets for raffles and bingo sold by an eligible entity are GST-free as long as the holding of the raffle or bingo event does not contravene a state or territory law.

The IRS considers a raffle ticket to be a contribution from which you benefit. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable donation. Raffle or art union tickets for example an RSL Art Union prize home items such as chocolates mugs keyrings hats or toys that have an advertised price the cost of attending fundraising dinners even if the cost exceeds the value of the dinner.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Citizen living in Australia we will help you review your Tax. Are Raffle Tickets Tax Deductible Australia.

Raffle tickets are not tax deductible. Unfortunately support via our raffle games are not tax deductible. Tax deductions are a way to reduce your taxable income and the amount of tax that you pay.

Marys Oratory is a 501c3 receipts are not available for the donation because IRS tax code does not consider raffle tickets tax deductible. For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation. Charity donations of 2 or more to Australian Red Cross may be tax-deductible in Australia.

If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive. For tax purposes lottery tickets cannot be regarded as a deduction if they are received as a gift. Buy a raffle ticket.

Winning ticket holder need be present at drawing to win and will be contacted the following business day. X must report 13333 as the gross winnings in box 1 of Form W-2G and 333467 withholding tax in box 2. Raffle tickets and lottery syndicates Unfortunately contributing to the monthly office sweep is not a deductible expense and neither are raffle tickets or lottery syndicates.

There has never been a better time to enter a Red Cross raffle. Donations of 2 or more made to an organisation that is defined by the Australian Tax Office ATO as a Deductible Gift Recipient. Give yourself a chance to win big and feel confident that your funds support vital Red Cross work.

Reporting and Paying Tax to the IRS. For a donation to be tax deductible the organisation has to be endorsed by the Australian Tax Office ATO as a Deductible Gift Recipient DGR. Are raffle tickets tax deductible.

If you would prefer to make a tax-deductible donation you can by asking during a raffle sales call or using your states RSPCA website donation page links at the bottom of the page. Such as a raffle ticket. The same applies to the purchase of raffle tickets.

Find information on allowable work travel business and family tax deductions. Hilby says that even though St. Yes once payment is made for their raffle ticket they will be emailed a payment receipt from your Stripe account.

This is the standard Australian Tax Office calculation. This is because the purchase of raffle tickets is not a. For more information see the relevant regulations in each State.

Only donations to registered charities are tax deductible. As part of the permit process you will need to supply certain information about your use of the RaffleTix platform. If in Example 3 X pays the withholding tax on Jasons behalf the withholding tax is 333267 10000 fair market value of prize minus 1 ticket cost x 3333.

We can assist you in that regard but ultimately your organisation will need to navigate the permit process. Find answers to your tax deduction questions in HR Block FAQs.

Are Raffle Tickets Tax Deductible Australia Ictsd Org

Letter For Donations Raffle Basket Ideas Hurray Donation Throughout Donation Card Template Fr Donation Letter Template Donation Request Letters Donation Letter

Marketing Outreach Plan Template Unique Donation Letter Raffle Ideas Pinterest Donation Letter Donation Letter Template Fundraising Letter

Tax Deductible Donations An Eofy Guide Good2give

How To Claim A Tax Deduction On Christmas Gifts And Donations

How To Know If Your Charitable Donations Are Tax Deductible

Tax Deductible Donations An Eofy Guide Good2give

Cornhole Tournament To Benefit Relay For Life Follow Us On Twitter Lynne Schneider For Life Of Vinings Smyrna Ga Relay For Life Relay Cornhole Tournament

Tax Deductible Donations Reduce Your Income Tax The Smith Family

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Raffle Tickets Auction Fundraiser

Felicitation Certificate Template New Sample Business Thank You Letter For Attending An Event Va Donation Letter Donation Letter Template Certificate Templates

Letter Requesting Donations For Silent Auction Download This Silent Auction Donation Reques Donation Letter Donation Letter Template Donation Request Letters

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Pin On Cover Letter Templates Design

Donations And Deductions Bishop Collins